All Categories

Featured

State Ranch representatives offer whatever from house owners to car, life, and other popular insurance policy items. State Ranch uses universal, survivorship, and joint universal life insurance coverage policies - universal whole life vs whole life.

State Ranch life insurance is typically conservative, offering steady choices for the average American household. If you're looking for the wealth-building opportunities of universal life, State Farm lacks affordable alternatives.

Still, Nationwide life insurance policy plans are highly obtainable to American households. It helps interested celebrations get their foot in the door with a reliable life insurance coverage plan without the much more complicated conversations about investments, economic indices, etc.

Nationwide fills up the crucial function of getting reluctant purchasers in the door. Even if the worst takes place and you can not obtain a bigger plan, having the protection of an Across the country life insurance coverage plan can transform a buyer's end-of-life experience. Read our Nationwide Life Insurance evaluation. Insurer use medical examinations to evaluate your danger class when using for life insurance.

Buyers have the choice to change prices each month based on life circumstances. A MassMutual life insurance coverage agent or monetary expert can aid customers make plans with space for modifications to fulfill short-term and lasting monetary goals.

Universal Life Ideal

Read our MassMutual life insurance policy review. USAA Life Insurance Coverage is understood for providing affordable and thorough economic products to military members. Some purchasers might be stunned that it provides its life insurance policy policies to the public. Still, army participants take pleasure in special benefits. Your USAA policy comes with a Life Occasion Choice rider.

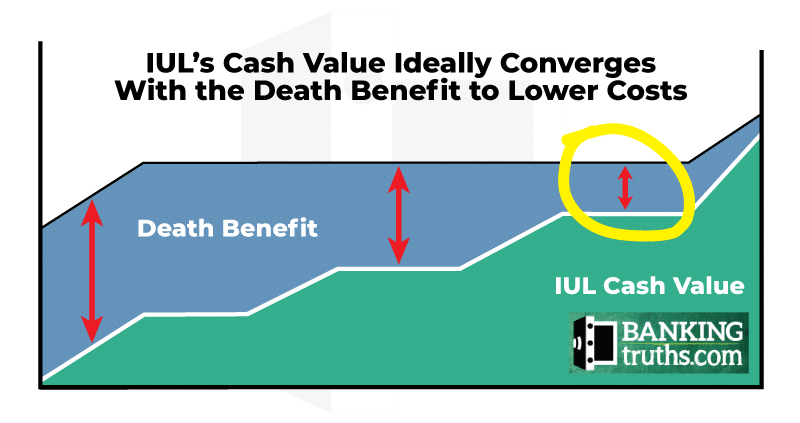

If your policy does not have a no-lapse guarantee, you might even shed insurance coverage if your cash value dips listed below a certain limit. It may not be an excellent choice for people who merely want a death advantage.

There's a handful of metrics by which you can judge an insurer. The J.D. Power consumer fulfillment rating is an excellent option if you desire an idea of just how consumers like their insurance coverage. AM Best's monetary strength score is another vital statistics to consider when choosing an universal life insurance coverage business.

This is particularly crucial, as your cash money worth expands based on the investment choices that an insurance coverage company uses. You need to see what investment options your insurance policy provider deals and contrast it against the objectives you have for your plan. The very best way to locate life insurance policy is to collect quotes from as lots of life insurance policy firms as you can to recognize what you'll pay with each policy.

Latest Posts

Master Iul

Iul Agent Near Me

Variable Universal Life Vs Indexed Universal Life